Project Overview

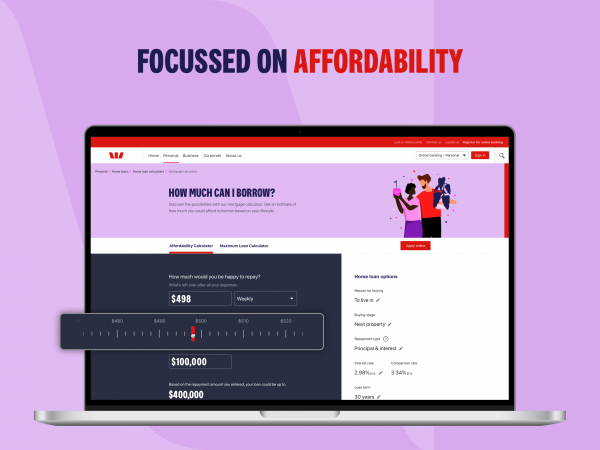

Homeownership is part of the Australian dream and critical to that journey is understanding borrowing power. Borrowing calculators typically provide a one-dimensional view of borrowing ability, which is why at Westpac we’ve reimagined the calculator, challenging design convention and uplifting our technical framework, to create a dynamic, fit for purpose model.

Organisation

Team

Polly Averill: Visual Designer

Evelyn Hernandez: Experience Designer

Bavo Dessein: Product Owner

Hamish McCluggage: Digital Mortgage & Capability Service Owner

Project Brief

Calculators are a key lead generator for our home loan business, contributing to over 60% of website traffic. We were tasked to increase engagement and conversion through a market leading design and technical framework.

This transformation was informed by extensive customer research where we learned the importance of calculators in the home loan journey, and how they often fail to meet expectations. We set out to make understanding borrowing capacity and affordability easier for our customers, while laying out a strong foundation for the delivery of future calculators.

Project Need

Banking calculators are typically the same; stand-alone experiences, driving high volumes of traffic with low user engagement and conversion rates. Providing complex, rigid, and overwhelming experiences with intangible outcomes, they are built to align with internal systems. With these obstacles to overcome, we needed a dynamic design with best-in-class experiences, that explained simply, loan scenarios and serviceability. Then we needed to shift our messaging focus to affordability and education, rather than on borrowing capacity. And finally, we needed to uplift our existing technical framework, from static code to a more flexible model that could be updated or scaled.

User Experience

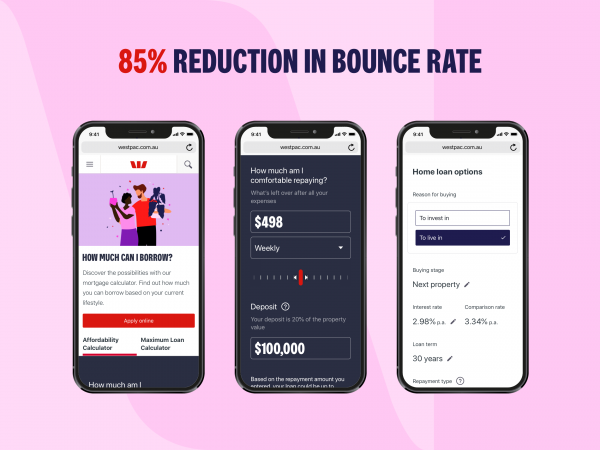

With affordability being the new focus for the Westpac borrowing calculator, our breakthrough design is ticking all the boxes. Not only does the model align with our position as a responsible lender, but it also has our end users needs clearly in sight. The dynamic fields mean users can instantly see their borrowing capacity from multiple angles – starting with whichever lending scenario best suits their needs. Whether they want to focus on what repayments they can afford or how much of a deposit they need, over different loan periods and with different available interest rates, meaningful figures are instantly revealed. Users can also simply dial-up or down repayment amounts with a dynamic moveable scale to instantly see how that affects their borrowing power. Simple, fast and effective, the Westpac borrowing calculator is helping Australians fulfil their homeownership dreams, with realistic and affordable outcomes.

The redesign showed improved results instantly. The highly interactive experience allowed users to see in real-time the impact of changing a variable on their loan scenario. This resulted in more than 80% of visitors engaging with the tool, equating to an 85% drop in bounce rate. Users of the new tool were also 1.5 times more likely to complete a home loan application. In tandem, a new enterprise-wide framework was delivered increasing speed to market of new experiences, reducing development time by a third, with deeper systems integration, allowing more accurate and personalised insights.

Project Marketing

Our new calculator has been featured on various PR articles focused on First Home Buyers, improving our SEO authority for this page.

Project Privacy

The privacy and security of customer's personal information is important to us at Westpac. We are committed to protecting your privacy where needed. The Westpac Mortgage Calculator itself does not collect any personal data.

Digital - Finance

Fintech is radically changing how we live as society and how we do business professionally. We're looking for great apps and sites that are disrupting sectors such as mobile payments, money transfers, loans, fundraising, financial management.

More Details