Project Overview

Tyro exists to provide Australian businesses with innovative products and services to help improve and grow their business.

From humble beginnings as an alternative payment provider with integrated EFTPOS, Tyro recently launched lending and deposit products, and we are considering expanding into other services in the future.

Tyro is the first and only technology company in Australia granted an unrestricted banking licence and now serves more than 18,000 small and medium merchants on completely home-grown infrastructure. This divine ownership and creation of all its platforms, has enabled the company to continue to disrupt the banking establishment at a blinding pace. It has also enabled us to redefine banking for the under-served 1.2 million small and medium-sized businesses across Australia.

Building Tyro from the ground up with a status “next” mindset, means we can accelerate product development for the market and achieve a faster release cycle.

Organisation

Team

Peter Haig Co-Founder

Andrew Rothwell Co-Founder

Paul Wood Co-Founder

Jost Stollmann CEO (2004 – 2016)

Justin Mitchell Company Secretary

Graham Lea Product Lead

Geoff Chiang Engineering Lead

Matthew Milliss Engineering Lead

Tyro Board and Directors

Every person who ever worked at Tyro Payments

Project Brief

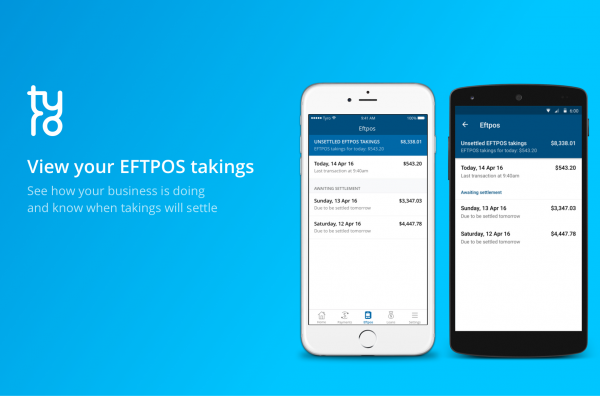

Tyro's core offering has been to offer fast, reliable and integrated EFTPOS solutions to Australian businesses. With a start-up attitude and a small employee base, Tyro seized the opportunity to become an industry disruptor – challenging the status quo and redefining business banking in Australia.

On this highly proactive and adaptive infrastructure, Tyro continues to rapidly innovate. Our technology mindset and capability places us in a unique position to build a multi-faceted and scalable services platform for Australian businesses, not only in the EFTPOS payments space but also with business banking and growth funding.

At the heart, our mission is to change the lives of our customers so they can achieve their version of success and spend more time on what matters to them.

Project Need

Tyro realised early on that if it wanted to provide innovative solutions and disrupt the banking establishment it would require a great deal of flexibility and control over its own infrastructure, systems, processes and services.

As such, Tyro embarked on addressing the needs of merchant card acceptance by building its own switch engines, infrastructure and interfaces to allow merchants to accept card payments, and at a competitive price. After launching and achieving steady growth, Tyro then began to address merchant pain-points using its deep technical knowledge and user perspective.

One of the early-recognised pain points was the lack of integration between the payment device (terminal), and the point-of-sale (POS) software operated by the merchant. The merchant requirement to enter the transactional data twice was error prone and clearly inefficient.

In only a few years, Tyro has become the preferred POS partner in Australia and now integrates with over 200 POS software providers – more than another other bank. This eliminates the need to re-key the transaction amount into the terminal. Tyro’s integration manages this on the behalf of the merchant; it pushes the amount from the POS to the Tyro terminal seamlessly and without error. This in turn decreases the risk for the merchant, reduces complexity and increases the efficiency of business operations.

Furthermore, in the hospitality sector, wait staff at restaurants and bars can request the bill amount from the Point-of-Sale without returning to the main counter. This ‘Pay@Table’ functionality increases the efficiency of restaurants, enabling a better experience for the merchant and their customers, which ultimately drives a higher turnover rate for the business.

Another product designed to reduce the burdens of doing business is our Tyro Growth Funding, which utilises the historical insight of the business’ takings to evaluate the lending risk for merchants. Based on this insight, merchants are offered low-cost loans via the Tyro App. They decide every aspect of the loan including the amount, the payback time-frame and the percentage of daily takings. Loan approval is rapid and funds are accessible within 60 seconds. The merchant receives a competitive loan with one fixed fee and has access to funds when they need it – not weeks later.

These are examples of rapid innovations that would not have been possible without the ownership of the entire infrastructure.

By working with merchants on a regular basis to understand their workflows and by collaboration with experience designers, product managers, infrastructure teams, compliance, operations and development, Tyro has the ability to rapidly innovate and provide exceptional value at a fraction of the time and cost of other banking institutions.

User Experience

At every stage of the product design cycle at Tyro, the human impact of our technology is integral in delivering a highly functional solution. Our internal product design team leads this experience, making use of both Lean principles to validate hypotheses, learn and measure, as well as Agile development that empowers the team to build incrementally and quickly.

The design cycle starts with meeting and observing users to understand their needs and opportunities to improve. We identify which burning problems need resolving and which obstacles to success need removing. We also run workshops as cross-functional teams (involving marketing, design, engineering and product) to solve the problems that constrain and impede our customers’ success.

These solutions are tested with realistic prototypes and real customers.We use the test results to validate or overturn our ideas. If, after rigorous testing, we decide that a solution effectively solves a customer problem and provides great value, our designers work with the engineering team to build out these solutions, testing and learning along the way with our customers. By way of example, we received requests from a number of hospitality customers to facilitate the ability to "correct" tips for bars and restaurants. At the end of the evening after a dinner service, or at close of bar, staff would go through and manually enter all the tips into the terminal (this is when we were writing a tip on the receipt and signing it), and at the end of a long night and wanting to get home, it was inevitable that errors were being made.

Within six weeks, we went from hearing about this problem to rolling out a solution in production. The "tip adjustment" feature was immediately put into use by the merchants who had requested it. We received positive feedback from them on our rapid solution to their ingrained problem and on how happy it had made their staff.

When we launch, we monitor our analytics for feature uptake and continue to work closely with our customers to understand how they are using these features, and how we can further improve the customer experience.

Project Marketing

Our internal customer facing teams work closely with the product team to establish if our individual customers’ needs are being met, and to ensure that the Tyro EFTPOS banking product continues to provide exceptional value. Our customer relationship management tools and home-grown databases capture user interactions across many customer touchpoints. This interaction is used to deeply understand the value of our solutions within multiple segments and provides valuable data for future design work.

Our in-house marketing team is digitally-oriented, using paid search and organic search, social media, and other direct response channels. Our Business Development Managers work with marketing to build strong relationships with Point-of-Sale providers to provide merchants with the message of a seamless solution. We currently partner with 200+ POS providers - more than any other bank in Australia. We have a presence at trade shows for our key markets - health, hospitality and retail - to provide merchants with the opportunity to experience our products.

In the near future we will be investing in above-the-line channels. With our advocate population growing, we find that referrals are a considerable source of increasing awareness in the small and medium merchant base.

Project Privacy

As a regulated entity like any other bank in Australia, Tyro is subject to the same policies, standards and procedures as governed under APRA.

Tyro's banking technology is built in-house, so it doesn't depend on many 3rd party providers. This reduces the risk of potential data and security issues.

When information is passed between Xero (for example) and Tyro, a private, secure connection between both organisations is used.

A Privacy Policy is provided during registration and login from the Tyro App is channeled through a 2-factor authentication process to ensure security.

User passwords are hashed and stored in secure servers based in Sydney, Australia.

FinTech

FinTech is radically changing how we live as society and how we do business professionally. We're looking for apps and tech solutions that are disrupting sectors such as mobile payments, money transfers, loans, fundraising, financial management.

More Details